Welcome to another edition of CRR!

As usual, we bring you a weekly umbrella report of all things crypto regulation and DeFi policy developments.

Several events took place over the past couple days, so fasten your seat belts as we take you through the highlights!

⚖️ Lawsuits, Court Rulings and Settlements

Tigran Gambaryan Speaks on Unpleasant Experience with Nigerian Government

Earlier in the week, Tigran Gambaryan, a U.S federal agent, top crypto investigator and employee of cryptocurrency giant, Binance, who was detained in Nigeria in 2024, dropped explosive revelations about his ordeal with Nigerian authorities.

He alleges that government operatives colluded with House members to demand a $150M bribe in crypto, fabricated evidence, and misrepresented trade data as a $26B mystery fund. He also exposes a chaotic operation involving illegal detentions and false narratives.

This was revealed in a viral thread made by Andy Greenberg as an introduction to his explosive and lengthy piece titled, “The Untold Story of a Crypto Crimefighter’s Descent Into Nigerian Prison.” Read the full story here.

⚖️ Criminal Matters

USA v. Kucoin: Kucoin pleads Guilty, agrees to Pay $300 Million Penalties

Leading crypto exchange platform, Kucoin recently pleaded guilty to unlicensed money transmission charges, agreed to exit the U.S market for at least the next two years, and pay monetary penalties to the tune of almost $300 million. Additionally, two of KuCoin’s founders, Chun Gan and Ke Tang, who were indicted along with Peken Global Limited (Kucoin's operating entity) in March 2024, agreed that they will no longer have any role in KuCoin’s management or operations.

Kucoin was accused of flouting U.S. anti-money laundering laws by failing to implement effective anti-money laundering (AML) and know-your-customer (KYC) programs and failing to register with the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN).

In addition to the guilty plea, Kucoin agreed to criminally forfeit $184.5 million and pay a criminal fine of about $112.9 million. Additionally, Gan and Tang have each agreed to forfeit approximately $2.7 million in funds received as a result of KuCoin’s operations in the U.S.

Canadian Indicted for $65 Million DeFi Fraud

On February 3rd, a Federal court in Brooklyn charged 22-year old Canadian, Andean Medjedovic with wire fraud, computer hacking and attempted extortion for stealing approximately $65 million in cryptocurrency from two DeFi protocols, KyberSwap and Indexed Finance. Medjedovic has also been charged with laundering the proceeds of the “sophisticated fraud” scheme.

The Press Release showed that he exploited vulnerabilities in Smart Contracts and stole millions of dollars in crypto, first in 2021 under Indexed Finance, and then in 2023 under KyberSwap protocol.

In the case of KyberSwap, after hacking into the system and stealing millions of dollars in crypto, Medjedovic also allegedly attempted to extort the developers of KyberSwap, its investors and members of its dentralized autonomous organization (DAO) by demanding control of the protocol and DAO in exchange for which he would return 50% of the stolen cryptocurrency.

Kyberswap was not Medjedovic’s first attempt, as he carried out similar operations against Indexed Finance in 2021 by using manipulative trading to exploit two of its liquidity pools on the Ethereum network. He then stole approximately $16.5 million in investor cryptocurrency from the liquidity pools.

Later in 2022, he also allegedly conspired with another person to launder the proceeds of his illegal conduct through crypto exchange accounts that were opened using false information, and by using a cryptocurrency mixer. Furthermore, he allegedly documented his process for laundering large amounts of crypto through a mixer in a playbook titled, “moneyMovementSystem” and discussed how KYC procedures could be circumvented for “hacks and cashing out” in other documents.

U.S convicts Chinese Nationals, seizes Multiple Websites and Crypto Accounts for Drug Importation and Money Laundering Schemes

According to a Statement released on the official website of the U.S Department of Justice (DOJ) under the authority of Danielle Sassoon, the U.S Attorney for the Southern District of New York, and Derek Maltz, the Acting Administrator of the U.S. Drug Enforcement Administration (DEA), a jury has given a guilty verdict against Qingzhou Wang and Yiyi Chen on fentanyl precursor importation and money laundering charges.

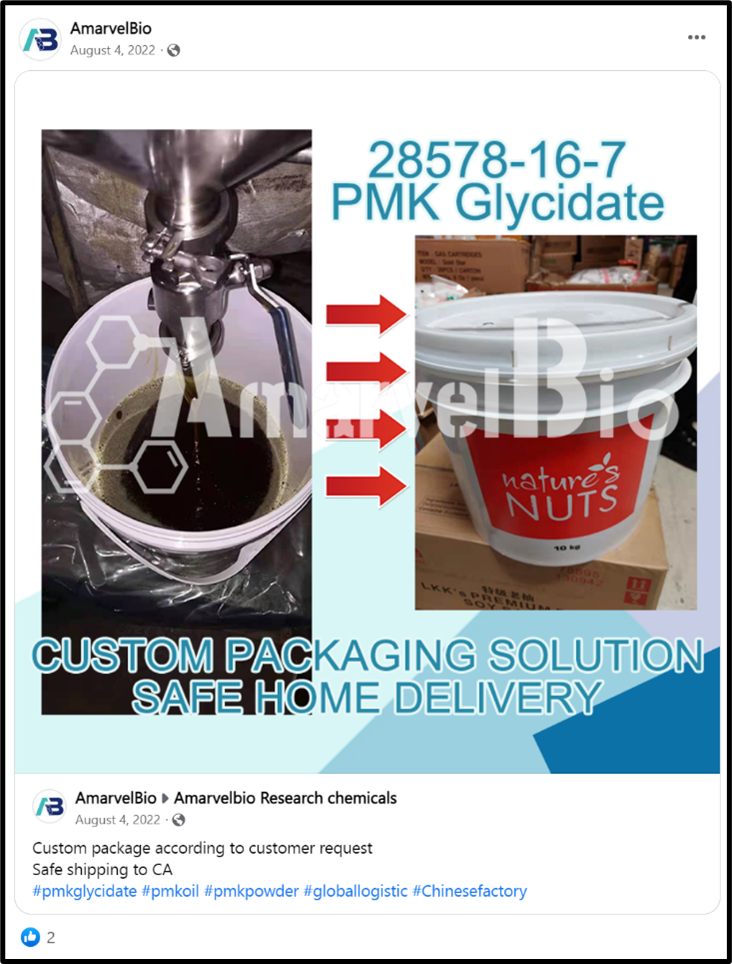

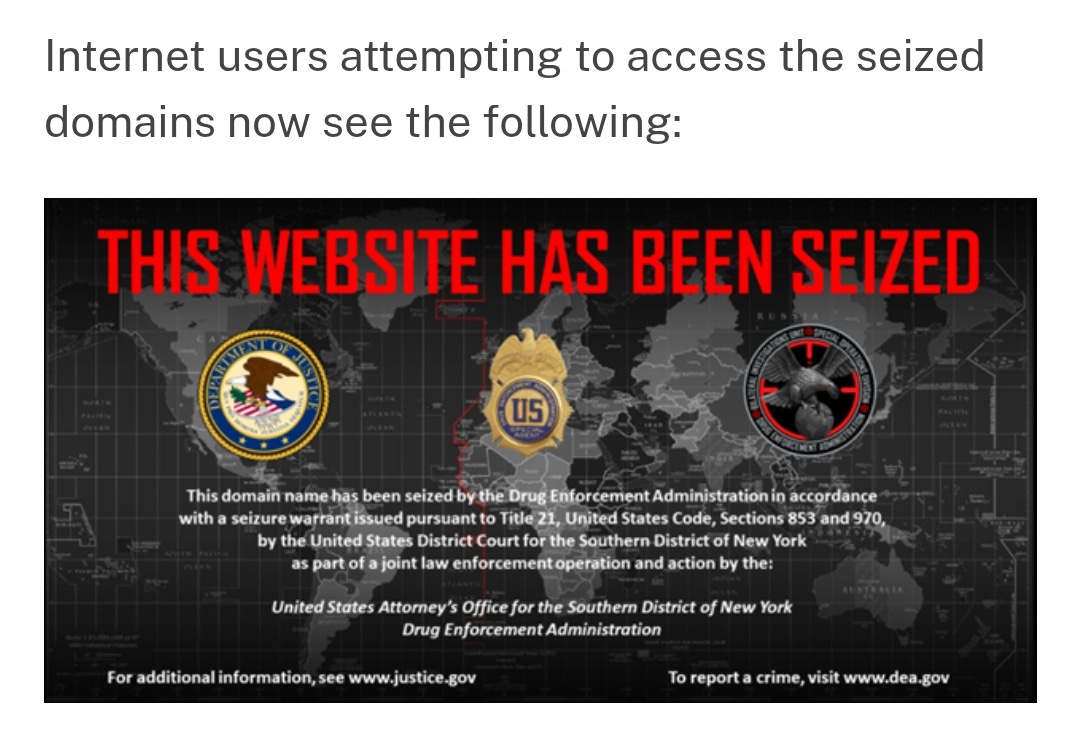

Sassoon and Maltz also announced the seizure of domain names for seven websites and four cryptocurrency accounts, totaling about $900,000 worth of digital funds, tied to the illicit precursor chemical business of the defendants, “Amarvel Biotech.” Sassoon said:

“Qingzhou Wang and Yiyi Chen conspired to import massive amounts of fentanyl precursors from China into the United States. They did so with callous disregard for the effect that such deadly chemicals would ultimately have here in the United States. Now, they stand convicted in an American courtroom and face a substantial term of imprisonment for their crimes... The message should be clear: we are watching, and we will continue to dismantle these fentanyl precursor operations, and bring the individuals responsible to justice.”

The Press Release further revealed that the chemical company openly advertised online its sale of precursor chemicals for use in manufacturing fentanyl through its website and several other storefront sites, targeting precursor customers in Mexico which is a hub for drug cartels with clandestine laboratories and promising them “100% stealth shipping” abroad.

Wang and Chen were both convicted of one count of conspiracy to import the fentanyl precursor chemical and one count of conspiracy to commit money laundering, each carrying a maximum sentence of 20 years in prison. Wang was additionally convicted of one count of importation of the fentanyl precursor chemical with a maximum sentence of 20 years in prison, and one count of importation of the methamphetamine precursor chemical methylamine, which carries a max sentence of 10 years in prison.

⚖️ Global Developments in Regulatory Frameworks and Policies

Bank of Ghana to Release eCedi in 2025

The Bank of Ghana (BoG) has announced its plans to roll out the retail version of its central bank digital currency (CBDC), the eCedi, by the end of 2025. This announcement comes after a two-year pause, even after the CBDC recorded a successful pilot program.

According to Kwame Oppong, the Fintech and Innovation Lead at the BoG, this launch is still reliant on the passage of a legislative act. Oppong also stated that the BoG aims to prioritize offline access to the eCedi so as to serve remote communities and foster financial inclusion in its real sense. This is laudable in consideration of the fact that 47% of Ghanaians lack internet access, and a CBDC without offline functionality would exclude nearly half the population from enjoying its benefits.

In furtherance of this goal, the bank also plans to integrate offline payments technology such as point-of-sale and near-field communications into eCedi’s structure to help Ghanaians easily access it offline.

In other news about CBDCs, a report by Giesecke+Devrient and the Official Monetary and Financial Institutions Forum (OMFIF), relying on findings from a global survey of central banks on CBDCs, reveals that Central banks in emerging markets, especially Africa, are making plans to issue a CBDC within one to two years. Developed countries, on the other hand, are reportedly targeting a longer timeline of three to five years.

U.S SEC & CFTC team up for Crypto Regulation Moves

Given the increased usage and regulatory interests that digital assets globally and in the US, the US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are now making moves towards ensuring regulatory consonance. Both agencies are now reportedly discussing ways to collaborate and present a more effective and harmonized approach towards the regulation of the crypto industry.

According to internet personality, Eleanor Terrett, one of the major proposals under consideration is the reintroduction of the CFTC-SEC Joint Advisory Committee, a body which was first created in 2010 to address emerging regulatory issues but has been dormant since 2014.

The Acting Chair of the CFTC Pham has been a strong advocate for reviving this advisory committee, emphasizing its potential to serve as a platform for cooperation between the two agencies. Last year, he called for its reform, describing it as a “strong signal of a new collaborative and cooperative U.S. regulatory approach to digital assets.”

In relation to this, Brian Quintenz a former CFTC commissioner known for his vocal support of DeFi and industry-led regulatory frameworks, has been nominated by President Donald Trump to lead the CFTC. His appointment could significantly shape the regulatory landscape for crypto markets, as lawmakers push to expand the CFTC’s jurisdiction over digital assets.

According to Carlo D'Angelo, if this Committee is reinstated, it could play a crucial role in shaping future regulations, influencing policies on asset classification, market structure, and compliance requirements. Some industry participants have expressed optimism that a more cooperative regulatory environment could lead to: clearer guidelines on whether specific digital assets fall under securities or commodities laws, reduced enforcement uncertainty that has stifled innovation and deterred investment, and create a more balanced regulatory approach that promotes investor protection while fostering technological advancements.

Dubai Authority issues Warning on Memecoin Risks, hints at Regulations

In a statement issued on Feb. 13, Dubai’s crypto regulator, the Virtual Assets and Regulatory Authority (VARA) has warned against the risks associated with trading memecoins, cautioning investors against speculative and unregulated assets.

The regulatory body highlighted that these assets are speculative, volatile and subject to market manipulation, stating that:

“Many such assets lack intrinsic value and derive their pricing from social media trends, hype, or misleading promotional strategies.”

VARA urged investors to beware of memecoins promising unrealistic gains, as such often lead to fraudulent schemes and memecoins may rapidly collapse, causing significant financial losses of investor funds.

VARA also stated that memecoins issued from Dubai must conform to certain rules enforced by VARA, including its 2023 “Full Market Product Regulations” which cover promotions, advertising and solicitations applicable to market participants within Dubai, excluding those under the Dubai International Financial Centre (DIFC). The rules provide that violators may be fined as much as $135,000 for failure to comply with marketing rules.

Later in September 2024, VARA tightened its crypto marketing rules even further by adopting stricter requirements for companies promoting digital assets in the country, including obligations to add disclosures to promotional material and receive regulatory compliance confirmation. These rules are put in place to ensure that incentives made available are not used to mislead investors on the risks associated with crypto investing.

And that’s a wrap!

These regulatory developments and many more that have occured in recent times foretell the turbulence that the crypto industry will face in its quest for global adoption.

Which of these events caught your attention the most? Comment your thoughts below.

See you next week!🥂